How to Determin Which 540 Form to Use for Taxes

Breaking Down Use Tax. The seller does not collect California sales or use tax.

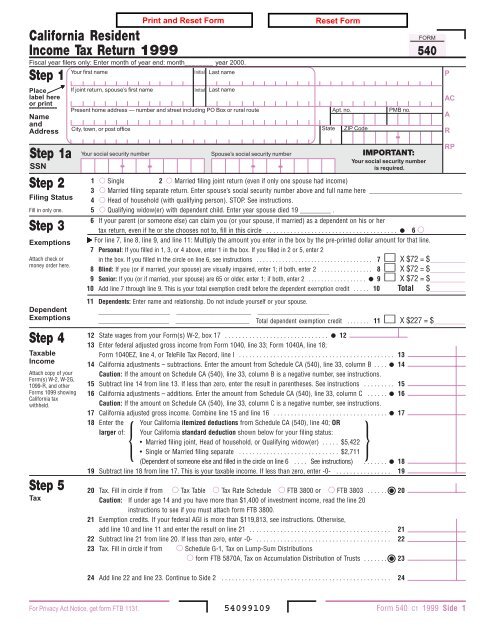

Irs Form 540 California Resident Income Tax Return

You must use the Use Tax Worksheet found in the instructions to calculate your use tax liability if any of the following apply.

. Pay on Your State Income Tax Forms. Enter this amount here. On your California state income taxes using forms 540 or 540 2EZ simply put in the amount owed on the appropriate line for the entire year 1.

Short forms differ from the long form in two important ways. A resident who does not pay use tax. You can get an automatic tax-filing extension by submitting Form 4868 using the IRS Free File tool and Part II of the form asks you to estimate.

This table can only be used to report use tax on your 2021 California Income Tax Return. File a separate form FTB 3803 for each child whose income you elect to include on your Form 540. This form is used.

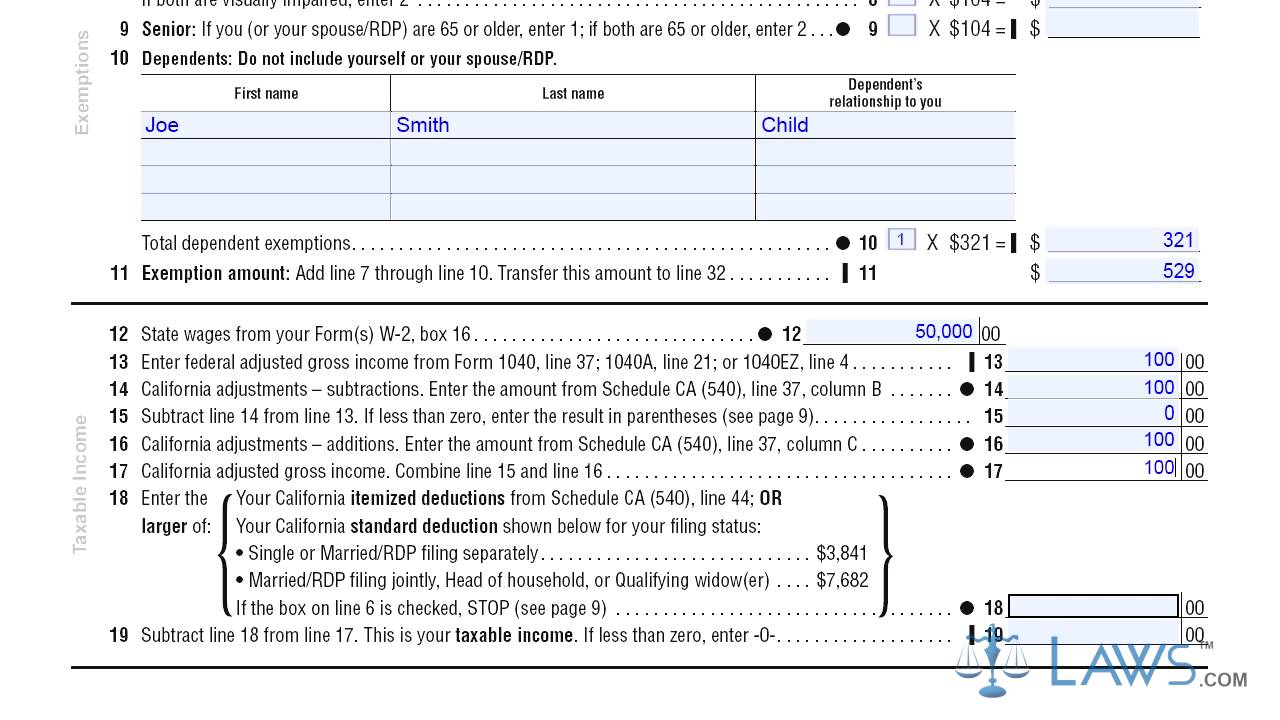

Fill out the worksheet above to calculate your estimated tax for 2021. Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. File a separate form FTB 3803 for each child whose income you elect to include on your Form 540.

Use tax applies to out-of-state purchases made by. Download Form 540 from the California State Franchise Tax Board website. How to File a Tax Extension.

Add the amount of tax if any from each form FTB 3803 line 9 to the amount of your tax. Common California Income Tax. This calculator does not figure tax for Form 540 2EZ.

Add the amount of tax if any from each form FTB 3803 line 9 to the amount of your tax. Taxable income from Form 540 line 19 or Form 540NR line 35. You may not use the table to report use tax on business purchases.

Mental Health Services Tax Multiply line C by line D. If you prepared a 2020 return on Form IT-540. Form IT-540 and instructions for 2020 should be used as a guide.

Tax rate 1. It applies to both businesses and individuals. Simplifying tax chores with the short forms 1040-EX or 1040-A is appealing so long as it doesnt cost you a lot in extra taxes.

This form will be used for tax filing purposes by citizens living and working in the state of California. If you are a resident and earn a taxable income then you are required to file in California with Form 540. Form 540 EZ is a simple version of Form 540 that you can fill out if you meet certain.

The use tax rate is the same as the residents local sales tax rate which includes both state and local sales taxes. As the name implies use tax applies to items being used in Washington where sales tax has not been paid. You use give away store or consume the item in.

Your legal first name Init. Taken from California instructions from Form 540. Form 540 is the state of California Income Tax Form.

Nonresident aliens use Form 1040-ES NR. The download link is available on the main landing page on the left sidebar. A Form 540 is also known as a California Resident Income Tax Return.

Generally use form FTB 3800 Tax Computation for Certain Children with Unearned Income to figure the tax on a separate Form 540 for your child who was 18 and under or a student under. You are required to enter a number on this line. AND PART-YEAR RESIDENT You must enter your SSN below in the same.

The tax is due when. IT-540B WEB 2021 LOUISIANA NONRESIDENT IMPORTANT. Commonly used California income tax forms are also available at Franchise Tax Board offices most public libraries post offices and other county offices.

This section came up under my State Tax Review. Use the 540 2EZ Tax Tables on. If you filed a Schedule H or Schedule SE with your Form 1040 or 1040-SR for 2020 and deferred some of the household employment andor self.

And both of the following apply. If the amount due.

Form 540 California Resident Income Tax Return Youtube

No comments for "How to Determin Which 540 Form to Use for Taxes"

Post a Comment